schedule c tax form meaning

As you can tell from its title Profit or Loss From Business its used to report both income and losses. That profit or loss is then.

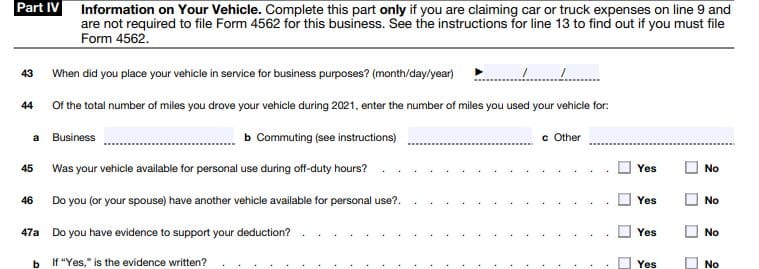

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

Its for businesses that are an unincorporated sole.

. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year. Schedule C is an important tax form for sole proprietors and other self-employed business owners. The Schedule C form calculates the net profit for independent contractors and small business owners.

The IRS Schedule C Profit or Loss from Business is a tax document that you submit with your Form 1040 to detail your businesss income and costs. Schedule C of Form 1040 is a tax document that must be filed by those who are self-employed. This is where self-employment income from the year is entered and tallied.

An organization that answered Yes on Form 990-EZ Part V line 46 or Part VI line 47 must complete the appropriate parts of Schedule C Form 990 and attach Schedule C to. After your calculation of expenses and income the form will show. Go to line 32 31.

Schedule C is the tax form filed by most sole proprietors. You fill out Schedule C at tax time and attach it to or file it electronically with Form 1040. The IRS looks very closely at the Expenses you list on your Schedule C as offsets to the income you earned with the Business.

Income tax form that is used by taxpayers to report itemized deductions which can help reduce an individuals federal tax liability. Profit or Loss From Business Sole Proprietorship shows how much money you made or lost when you operated your own. Its used to report profit or loss and to include this information in the owners.

Schedule C is where you record your business income and expenses and your overall profit or loss for that tax year. IRS Schedule C is a tax form for reporting profit or loss from a business. What is Schedule C.

The resulting profit or loss is typically. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. The profit or loss that.

If you have a loss check the box that describes your investment in this activity. A Schedule C is one of the most important tax forms to complete for a business owner or sole proprietor. Many times Schedule C filers.

If you checked 32a enter the. Form 1041 line 3. If the IRS or the States audit you you will.

In other words it counts as self-employment income and you do have. If a loss you. Schedule A is a US.

Solved Schedule C Form 1040 Profit Or Loss From Business Chegg Com

.png)

Form W 9 What Is It And How Is It Used Turbotax Tax Tips Videos

Complying With New Schedules K 2 And K 3

Business Activity Code For Taxes Fundsnet

Irs Schedule C What Is It Jackson Hewitt

What Is An Irs Schedule C Form

Schedule C What Is It For And Who Has To Fill It Global Tax

Free 9 Sample Schedule C Forms In Pdf Ms Word

What Is A Schedule C Tax Form Legalzoom

How To Fill Out Your 2021 Schedule C With Example

Schedule C Form Fill Out And Sign Printable Pdf Template Signnow

22 Tax Deductions No Itemizing Required On Schedule 1 Don T Mess With Taxes

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

What Is A Schedule C Stride Blog

:max_bytes(150000):strip_icc()/Form1041Year2021-91aed92e44524bc99dbb7c21c1913264.png)